There are three major questions that have to be answered. First, is it a realistic place for a new venture to enter? Second, does the industry contain markets that are ripe for innovation or are underserved? Third, are there positions in the industry that will avoid some of the negative attributes of the industry as a whole?

Studying Industry Trends

Environmental and business trends are the two most important trends for entrepreneurs to evaluate.

1. Environmental Trends

Economic trends, social trends, technological advances, and political and regulatory changes are the most important environmental trends for entrepreneurs to study.

2. Business Trends

In a similar fashion, the firms in some industries are able to move customer procurement and service functions online, at considerable cost savings, while the firms in other industries aren’t able to capture this advantage. Trends such as these favor some industries over others.

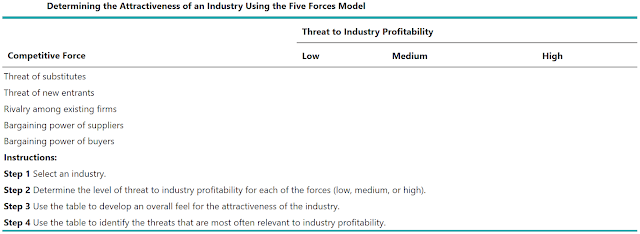

The Five Forces Model

Professor Michael Porter developed this important tool. Each of Porter’s five forces affects the average rate of return for the firms in an industry by applying pressure on industry profitability.

Porter points out that industry profitability is not a function of only a product’s features. Porter’s essential points still offer important insights for entrepreneurs such as the insight suggested by the following quote:

"Industry profitability is not a function of what the product looks like or whether it embodies high or low technology but of industry structure. Some very mundane industries such as postage meters and grain trading are extremely profitable, while some more glamorous, high-technology industries such as personal computers and cable television are not profitable for many participants."

A. Threat of Substitutes

Industries are more attractive when the threat of substitutes is low.

This means that products or services from other industries can’t easily serve as substitutes for the products or services being made and sold in the focal firm’s industry.

Products or services from other industries can’t easily serve as substitutes for the products or services being made and sold in the focal firm’s industry.

B. Threat of New Entrants

Industries are more attractive when the threat of entry is low. This means that competitors cannot easily enter the industry and successfully copy what the industry incumbents are doing to generate profits.

There are a number of ways that firms in an industry can keep the number of new entrants low. These techniques are referred to as barriers to entry. A barrier to entry is a condition that creates a disincentive for a new firm to enter an industry. Let’s look at the six major sources of barriers to entry:

1. Economies of scale

Economies of scale occur when mass-producing a product results in lower average costs.

2. Product differentiation

Product innovation is another way a firm can differentiate its good or service from competitors’ offerings.

3. Capital requirements

The need to invest large amounts of money to gain entrance to an industry is another barrier to entry.

4. Cost advantages independent of size

Entrenched competitors may have cost advantages not related to size that are not available to new entrants.

5. Access to distribution channels

Distribution channels are often hard to crack. This is particularly true in crowded markets, such as the convenience store market.

6. Government and legal barriers

In knowledge-intensive industries, patents, trademarks, and copyrights form major barriers to entry.

When start-ups create their own industries or create new niche markets within existing industries, they must create barriers to entry of their own to reduce the threat of new entrants.

C. Rivalry Among Existing Firm

In most industries, the major determinant of industry profitability is the level of competition among the firms already competing in the industry. Some industries are fiercely competitive to the point where prices are pushed below the level of costs.

1. Number and balance of competitors

With a larger number of competitors, it is more likely that one or more will try to gain customers by cutting prices.

2. Degree of difference between products

The degree to which products differ from one producer to another affects industry rivalry.

3. The growth rate of an industry

The competition among firms in a slow-growth industry is stronger than among those in fast-growth industries. Slow-growth industry firms must fight for market share, which may tempt them to lower prices or increase quality to obtain customers. In fast-growth industries there are enough customers to satisfy most firms’ production capacity, making price-cutting less likely.

4. Level of fixed costs

Firms that have high fixed costs must sell a higher volume of their product to reach the break-even point than firms with low fixed costs.

D. Bargaining Power of Suppliers

In general, industries are more attractive when the bargaining power of suppliers is low.

In some cases, suppliers can suppress the profitability of the industries to which they sell by raising prices or reducing the quality of the components they provide. If a supplier reduces the quality of the components it supplies, the quality of the finished product will suffer, and the manufacturer will eventually have to lower its price.

1. Supplier concentration

When there are only a few suppliers to provide a critical product to a large number of buyers, the supplier has an advantage.

2. Switching costs

Switching costs are the fixed costs that buyers encounter when switching or changing from one supplier to another. If switching costs are high, a buyer will be less likely to switch suppliers.

3. Attractiveness of substitutes

Supplier power is enhanced if there are no attractive substitutes for the products or services the supplier offers.

4. The threat of forwarding integration

The power of a supplier is enhanced if there is a credible possibility that the supplier might enter the buyer’s industry.

E. Bargaining Power of Buyers

In general, industries are more attractive when the bargaining power of buyers (a start-up’s customers) is low. Buyers can suppress the profitability of the industries from which they purchase by demanding price concessions or increases in quality.

1. Buyer group concentration

Meaning that there are only a few large buyers, and they buy from a large number of suppliers, they can pressure the suppliers to lower costs and thus affect the profitability of the industries from which they buy.

2. Buyer’s costs

The greater the importance of an item is to a buyer, the more sensitive the buyer will be to the price it pays.

3. Degree of standardization of supplier’s products

The degree to which a supplier’s product differs from its competitors’ offering affects the buyer’s bargaining power.

4. The threat of backward integration

The power of a buyer is enhanced if there is a credible threat that the buyer might enter the supplier’s industry.

The Value of the Five Forces Model

The five forces model can be used in two ways:

First, to help a firm determine whether it should enter a particular industry.

Second, whether it can carve out an attractive position in that industry.

Second, whether it can carve out an attractive position in that industry.

Industry Types and the Opportunities They Offer

It is helpful for a new venture to study industry types to determine the opportunities they offer.

Recent changes in demand or technology; the new industry standard operating procedures have yet to be developed.

B. Fragmented Industries

A large number of firms of approximately equal size.

C. Mature Industries

Slow increases in demand, numerous repeat customers, and limited product innovation

D. Declining Industries

Consistent reduction in industry demand

E. Global Industries

Significant international sales

Competitor Analysis

Competitor analysis is a detailed analysis of a firm’s competition. It helps a firm understand the positions of its major competitors and the opportunities that are available to obtain a competitive advantage in one or more areas.

The first step in the competitive analysis is to determine who the competition is.

1. Direct competitors

Businesses that offer products or services that are identical or highly similar

2. Indirect competitors

These competitors offer close substitutes to the product

3. Future competitors

These are companies that are not yet direct or indirect competitors but could move into one of these roles at any time.

B. Sources of Competitive Intelligence

A firm must first understand the strategies and behaviors of its competitors. The information that is gathered by a firm to learn about its competitors is called competitive intelligence (The information that is gathered by a firm to learn about its competitors).

The sources of competitive intelligence are:

- Attend conferences and trade shows

- Purchase competitors’ products

- Study competitors’ websites and social media pages

- Set up Google e-mail alerts

- Read industry-related books, magazines, websites, and blogs

- Talk to customers about what motivated them to buy your product as opposed to your competitor’s product